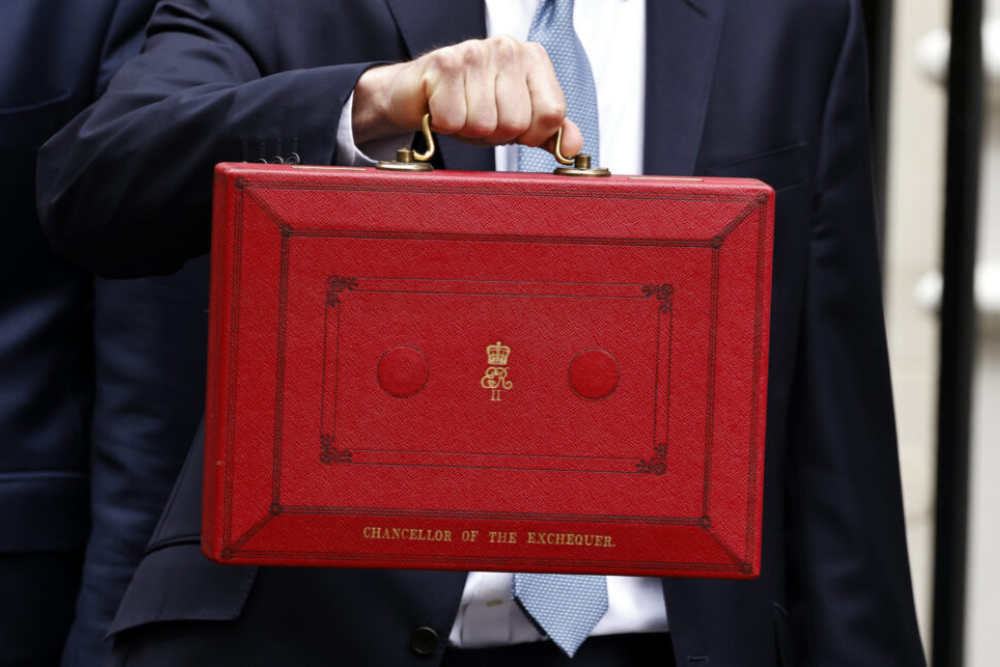

What are the implications of this year’s Spring Budget for your business and your employees? Here we’ve collated two expert perspectives.

What about the “squeezed middle” earners?

Amanda Lennon, employment partner at law firm Spencer West LLP explains that in today’s 2024 Budget announcement, the UK Chancellor, Jeremy Hunt announced the following initiatives which will impact workers:

- National Insurance is being cut by a further 2p from 10% (in the Autumn statement) to 8%, and for the self-employed from 8% to 6%. This is expected to save £450 per year for the average employee, or £350 for the average self-employed person. However the more an employee earns the higher their income tax, and the Budget does not cut income tax rates.

- The 30 hours of free childcare will be extended to all children over the age of 9 months, which Mr Hunt indicated will support a further 60,000 working parents. Having had 3 children in (expensive) early years childcare, this is great news as the 30 free hours really do help manage the cost of childcare. However, I can’t help feeling it judges parents who choose or need to return to work when their baby is younger than 9 months (as I did back in 2008, so that I could maintain my career) – I would rather see the 30 free hours applied from the point the parent actually returns to work, which would help more working parents.

- There are plans to make it easier for employees to transfer their pensions if they change jobs, although details are not yet available.

- Local authorities and defined contribution (DC) pension funds will have to disclose how much they have invested in UK shares, to encourage more investment in the UK. This is in the context of UK pension funds currently investing only 4% of their assets in UK shares.

- Child benefit will be changed to a household system by April 2026 to remove the unfairness of 2x adults in the household earning £49K being able to claim child benefit, when a household with 1 adult earning £50K cannot. More imminently though, from 6 April 2024 the high income child benefit threshold will be raised from £50K to £60K (so those earning up to £60K can still claim child benefit), and the top of the taper at which child benefit is withdrawn is raised to £80K (currently £60K).

- Expats in the UK will, after 4 years of living in the UK, have to pay the same tax as UK residents.

- Inflation has dropped to 4% from an 11% high in recent times, on track to meet the Bank of England’s 2% target – this is important in relation to employers’ pay review strategies (and any increases employees could expect to receive), many of which are taking place at this time.

She adds: “Whilst the National Insurance cuts and extension of the 30 hours free childcare scheme are welcome, there is nothing that will make a significant impact to the so-called “squeezed middle” earners who are not on very low incomes but have less money available to buy what they need than before, due to rising prices. I also can’t see from the Budget where the axe might fall in public spending in order to afford the initiatives that have been announced, particularly the National Insurance cuts and increase in the free childcare scheme.”

A double whammy missed?

Meanwhile, David Williams, head of group risk at independent intermediary specialising in health and wellbeing, Towergate Health & Protection, believes:

“The Spring Budget feels like a missed opportunity for the Government to recognise the enormous power of employee benefits in both reducing sickness and helping to improve the UK economy – both of which are key focus areas for the Government.

“The investment in the NHS to modernise IT equipment and improve their efficiency is welcome, but that was the only real nod towards support in the healthcare space. The Autumn Budget in November 2023 teased us with the “Back to Work” plan to support sick or disabled adults back into work along with a launch of the occupational health consultation. But today’s budget hasn’t built on this and that’s a missed opportunity.

“There was opportunity to expand to a wider view of employer-led interventions which go far beyond occupational health services. Employers with well-structured wellbeing programmes see reduced absence rates – often preventing absence from occurring in the first place – and more productive workforces. It would have been great to see measures announced in the Spring Budget which encouraged or incentivised businesses to support their employees in these areas. By building on their “Back to Work” plan in this way the Government could have taken great strides to reduce the UK sickness rates and boost the economic activity at the same time.”

You might also like: