If only money could talk, then perhaps it would tell us how we should talk to other people about it, because this remains a tricky topic culturally.

Indeed, in researching this article about how the soaring costs of living are collectively affecting our financial wellbeing, I also uncovered lots of pitfalls that companies were falling into when it came to opening the conversation. However, avoiding the conversation is not an option because financial wellbeing, as we are increasingly acknowledging, underpins our entire wellbeing and can be a huge source of stress and illness.

So, here are some 13 (unlucky for some, not for us!) of the major pitfalls to avoid when talking to your employees about their financial health.

1.Don’t assume that financial wellbeing is synonymous with pensions or a pay check

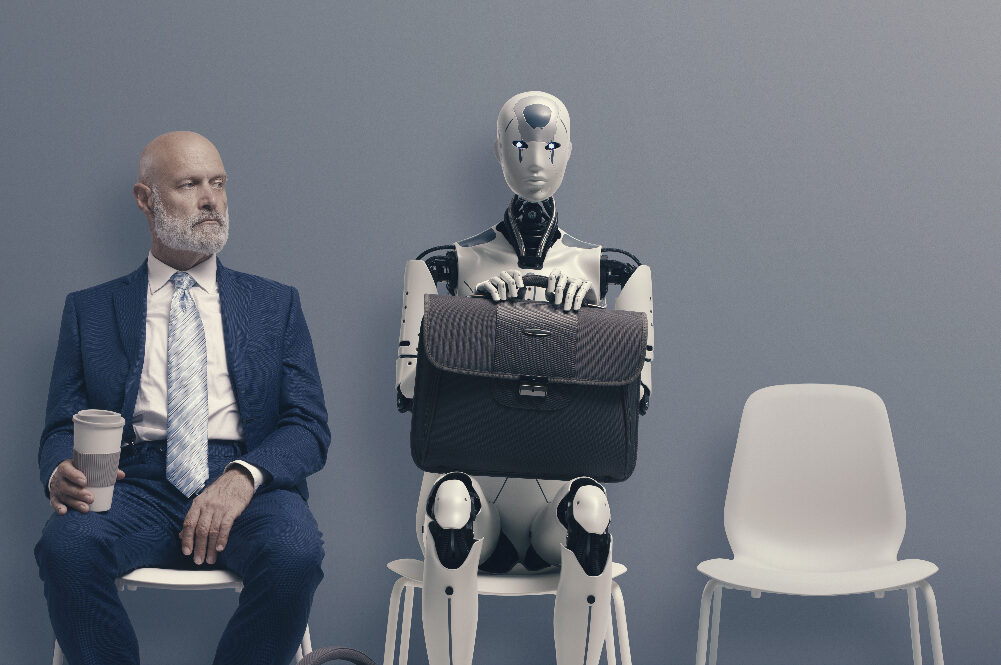

…and then wheel out a grey-haired man in a suit to talk to your employees en masse about setting up a pension. Yes, I am reliably told that this is still a “strong vibe” in the industry.

We need to look much more holistically at how we gauge financial health and wealth.

“Financial wealth is everything,” says Leigh Dunkley, financial wellbeing lead, Schroders Personal Wealth . “Yes, it’s your bank account. But it’s other savings, investments, pension protection, the roof over your head, car, clothes, jewellery… Anything you own or have in your life, makes up your wealth. We are not just defined by our pay check at the end of the month.”

2.Don’t give your employees financial advice

This is obvious, perhaps, to some but apparently not to all companies trying, with best intentions, to help boost employee financial wellbeing.

As Dunkley explains: “There’s a fine line between signposting to credible support and being seen to be giving your employees financial advice. You can’t do the latter.”

3. Don’t assume that the more money an employee has, the more financially ‘well’ they will feel

Underspending can also be a sign of financial ill-health.

It’s not what people earn, but how secure and in control they feel in their relationship with money that is related to wellbeing.

4.Don’t lecture your employees by having some financial expert talk ‘at’ them

Instead, give your employees the opportunity to take part in facilitated sessions where they contribute their own knowledge and thoughts.

“Then a good facilitator should add layers of knowledge on top of that existing information,” says Martha Lawton, a money coach who runs corporate financial wellbeing programmes. “This way you draw out the understanding in the room first which raises confidence. This is important because you get so many people saying they are ‘bad with money’. But there’s no such thing as that. There’s just building learning and confidence which feeds into a desire to act.”

5.Don’t talk to your employees about money as if they are one homogenous mass that views money the same way

The most effective way to talk to employees about money is to personalise their experience of your content as much as possible.

For instance, create content around money relevant to employees at key stages in their life: becoming a parent, starting work, those with disabilities, those who are moving house, getting married/divorced, etc.

6. Don’t run your financial wellbeing programme in isolation

Financial wellbeing underpins all wellbeing and gives people the freedom to invest in their health and happiness. Programmes work particularly well when tied in with diversity initiatives, learning & development, reward and internal communications.

7. Don’t forget that, as Tesco says with its coin-jangling tune, “every little helps”…

…when it comes to financial wellbeing.

As Lawton says: “Even a small, simple action like promoting a reward of the month in the staff newsletter, like EAP money advice service in January, bike loans in spring, etc, is an opportunity to promote aspects of the reward package employees might have forgotten about.”

8. Don’t overwork your employees

Overwork is associated with poor financial wellbeing. If employees are working too long hours they are more likely to spend their hard-earned cash on premium priced but less healthy options – such as ready meals and takeaway pizza. “Ask yourself – how can they be working smarter rather than longer hours?” says Lawton. (Also see our article on the 4 day working week, for more on this topic).

9.Don’t be embarrassed to ask your existing financial provider detailed questions about what support they are proactively offering for your employees

“Employees should feel comfortable asking ‘if I put this protection policy in place why would it benefit me and my family?’ says Dunkley. “Providers should be stepping up. You are probably earning them a nice lump sum or premium for them.”

10. Don’t be embarrassed to ask your existing financial provider about who will be delivering the financial education information…

…and if they are representative of a diverse population. This is not something that the finance industry typically does well but it’s vital, if you are going to resonate with the younger audiences, who are the group most stressed about money according to research, that your provider is relatable.

“It they aren’t relatable,” says Dunkley. “Then review the market! Change provider! We are very loyal as a nation but it does us a disservice.”

11. Don’t shame your employee concerning their financial health.

Facilities management company Mitie, for instance, rather than making its employees feel bad about charging their phones at work or showering at work to save money, they are encouraging them to do this if it helps them. Normalising the behaviour, and talking about it openly, strips its shame.

12. Don’t assume that your employees, especially the younger generation, know the financial basics; they may not

“A lot of young people are very stressed and anxious about money at the moment,” says Olamide Majekodunmi, who runs the online financial literacy site for young people All Things Money and who is starting to go into companies to deliver workshops and talks. “If they are not taught those basics they can overspend and get into debt. Buy now pay later is a huge problem. Everyone deserves a personal finance education but there’s not enough going on.”

Employees have a key role to play here, says Majekodunmi. For a start they can non-judgmentally help new graduates decipher their payslips so they understand exactly how income tax and national insurance, for instance, works.

13. Don’t forget to have a senior sponsor of your financial wellbeing programme.

As with all wellbeing, the message is better coming from the top. Even better if you have a senior sponsor, or leader, who is brave enough to be as open and honest about periods of financial ill-health as Dunkley is in this article, where she talks about how when her fiancé left her for another woman she neglected her financial wellbeing in the aftermath.

About the author

Suzy Bashford is a freelance journalist, podcaster and workshop facilitator.

Suzy Bashford is a freelance journalist, podcaster and workshop facilitator.

She is passionate about destigmatising mental health by creating a more honest, helpful narrative around it, and related topics like emotional intelligence, stress management and empathy. She also believes in the power of creativity and nature to improve our wellbeing, which she covers regularly in articles for the likes of Psychologies magazine and her own podcast, Big Juicy Creative.

When she’s not writing or podcasting, you’ll probably find her dipping in a cold loch, hiking with her dog or biking the mountain trails in the awesome Cairngorms National Park, where she lives.